In recent months, the Federal Reserve has signaled a willingness to dial down interest rates with alarming optimism, believing that minor adjustments can steer the economy toward sustainable growth. Yet, behind this seemingly cautious approach lurks a dangerous overconfidence—a faith in the power of monetary policy to solve deeper systemic issues. The decision to cut rates by a mere quarter percentage point, followed by dissent from newly installed Governor Stephen Miran advocating for a more aggressive, half-point cut, exposes a fundamental flaw: an over-reliance on short-term monetary fixes rather than addressing structural economic inequities.

Miran’s stance, which diverges sharply from the consensus, is not merely about numbers—it reflects a broader skepticism about the central bank’s capacity to manage the complexities of the current economic landscape. While some argue that such aggressive rate reductions could revitalize sluggish markets or prevent recession, this perspective underestimates the potential for unintended consequences, including asset bubbles, increased inequality, and long-term inflationary pressures. The Fed’s obsession with manipulating interest rates as a primary tool leaves society vulnerable to a political gamble masked as prudent economic stewardship.

The Risks of Politicizing Monetary Policy

The appointment of Stephen Miran, whose nomination was heavily influenced by political interests, raises critical questions about the independence of the Federal Reserve. When policymakers bow to presidential pressures—evidenced by Miran’s alignment with former President Trump’s aggressive calls for sharply lower rates—the risk of ideological meddling grows insidiously. Such influence undermines the fundamental tenet that monetary policy should be driven by economic data, not political expediency.

This scenario becomes even more troubling when we observe how Miran’s dissent echoes a broader push for extraordinary rate cuts, even as the economy exhibits resilient employment figures and consumer spending. Instead of recognizing the underlying strengths of the recovery, these moves hint at a desire to artificially accelerate growth—an attitude that disregards the importance of fiscal responsibility and social safety nets that acknowledge economic disparities. As a force promoting easy credit and lower borrowing costs, the Fed risks exacerbating wealth inequality, favoring the financial elite while leaving working-class households more vulnerable in the long run.

The Perils of Ignoring Structural Economic Challenges

This obsession with rate cuts, especially aggressive ones, inadequately addresses the root causes of economic instability. Structural issues—such as wage stagnation, rising inequality, and the erosion of social services—remain unmitigated, yet monetary easing is mistaken for comprehensive policy action. The reliance on artificially low interest rates to stimulate growth primarily benefits speculative markets, creating a fragile economic environment that is prone to sharp corrections.

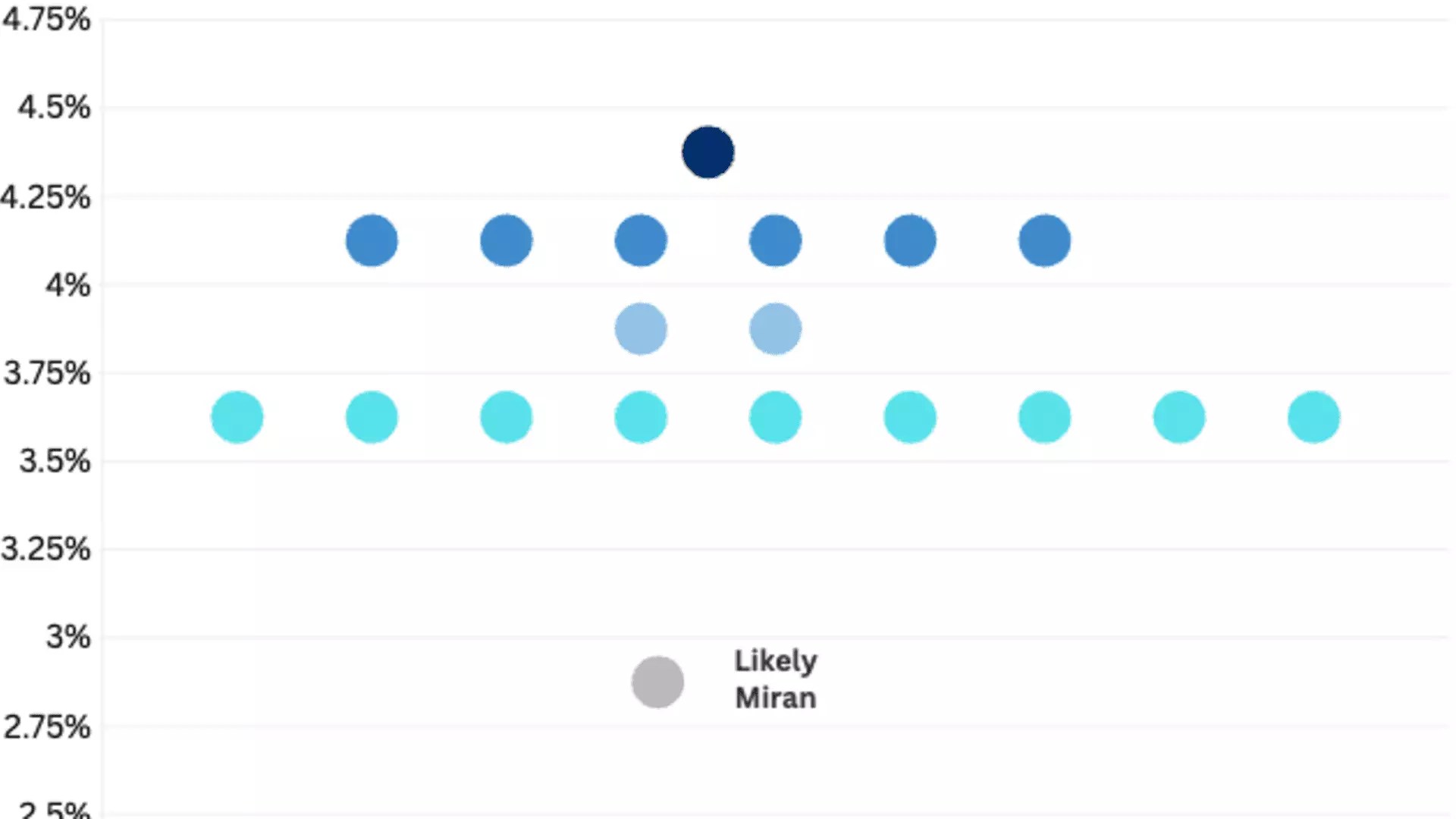

Moreover, the internal divides among Fed officials, as illustrated by the wide dispersion of rate cut forecasts, signal a lack of consensus and clarity within the institution itself. Miran’s push for steeper cuts reflects a broader ideological divergence—one that threatens to cause policymakers to prioritize short-term gains over long-term health. This approach risks igniting a cycle of dependency on monetary stimulus, which is neither sustainable nor equitable.

The Broader Implications on Democratic Accountability

Perhaps most troubling is the influence of political figures, like Trump, on the independence of the Federal Reserve. Miran’s appointment, underpinned by political motivations, exemplifies how monetary policy increasingly becomes a pawn in partisan battles rather than a safeguard for economic stability. The ongoing controversy over Trump’s attempts to influence the Fed—including his overt demands for lower rates—undermines democratic institutions and erodes public trust.

A resilient economy demands an independent central bank that resists political interference, not one that bends to the whims of a transient administration. The danger of politicized monetary policy is a slippery slope toward economic instability, where decisions are driven less by sound economics and more by electoral calculations. As a citizen advocating for center-left policies that balance social equity with economic prudence, it is clear that we must defend the Fed’s autonomy and reject simplistic fixes that only serve short-term political aims. Only through a commitment to structural reforms and sober monetary governance can we hope to foster a more equitable and stable future.