Palantir’s latest financial report seems to paint a picture of unstoppable momentum, but a closer look reveals cracks beneath the surface of these gleaming numbers. Surpassing a billion dollars in quarterly revenue for the first time is undoubtedly noteworthy—a milestone portrayed as a pinnacle of technological achievement. Yet, this milestone is largely driven by hype surrounding artificial intelligence and the company’s aggressive expansion strategy. Investors are seduced by the prospect of AI transforming industries, but they often overlook whether Palantir’s growth is sustainable or merely a product of inflated expectations and market speculation. High revenue growth, while impressive at first glance, doesn’t necessarily translate into long-term profitability—especially when viewed through a skeptical, centrist liberal lens that demands scrutiny of corporate claims versus actual societal value.

The Promised Efficiency or Cost-Cutting Mirage?

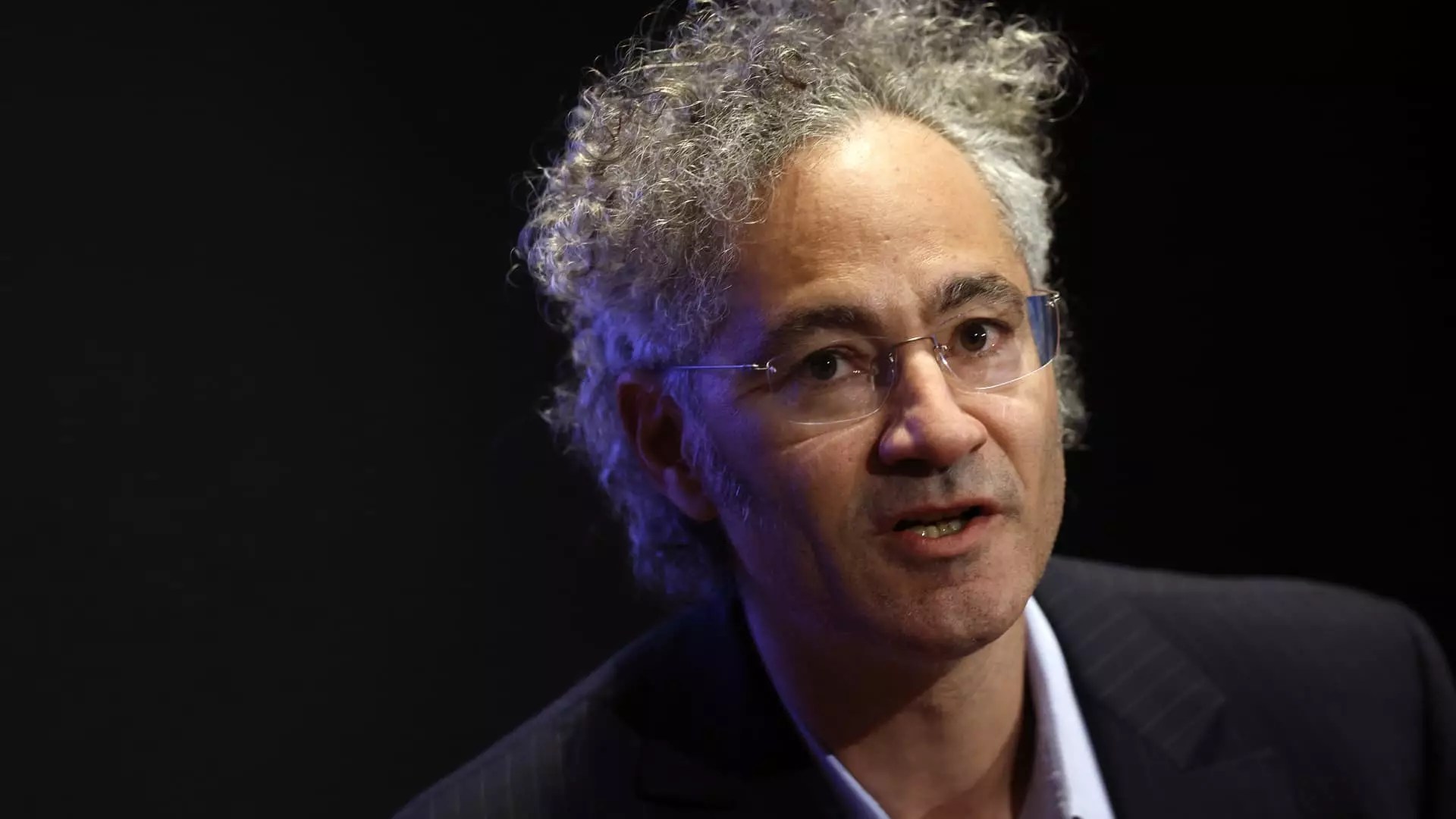

CEO Alex Karp’s statement about aiming to “grow revenue while decreasing our number of people” underscores a troubling trend: the pursuit of efficiency often masks underlying instability. The pursuit of a “crazy, efficient revolution” risks reducing staff to squeeze out profits, potentially at the expense of innovation and corporate responsibility. While reducing headcount could improve short-term margins, it raises questions about the quality of the company’s future offerings and its capacity to adapt. Are these layoffs driven by genuine automation and technological advancement, or are they simply cost-cutting measures designed to dilate profit margins temporarily? In a society increasingly concerned with job security and fair labor practices, such strategies appear shortsighted—favoring shareholder returns over workforce stability and societal well-being.

Overhyped AI and the Reality Check

Palantir’s optimism regarding the convergence of language models, hardware advancements, and software infrastructure appears to be riding the crest of an AI wave that might not yet be ready for the sweeping promises made. While the company claims that this convergence will lead to a “crazy, efficient revolution,” the reality is often messier. Many industry skeptics question whether these AI tools are genuinely transformative or if they’re just sophisticated data processing systems repackaged for the hype cycle. The narrative that Palantir’s AI capabilities are a game-changer seems exaggerated, especially given that the core technology has been evolving for years before the current boom. Gearing up to be a leader in AI is compelling, but it should not overshadow the importance of transparency, ethical considerations, and societal impact.

The Market Valuation: A Dangerous Bubble?

The company’s meteoric rise to a market cap exceeding $379 billion captures the imagination—yet it also signals a potential bubble fueled by fervent investor speculation. At a multiple of 276 times forward earnings, Palantir’s valuation sharply diverges from traditional valuation metrics, raising alarms about whether the stock is driven more by market psychology than fundamentals. Comparatively, even Tesla, known for its high multiples, trades at significantly lower ratios. This disconnect calls into question whether Palantir’s immense market value is justified by tangible growth or merely a reflection of the financial markets’ willingness to chase the latest AI darling. For many, this hypervaluation resembles a dangerous speculative frenzy that could burst if the company’s actual long-term profitability fails to meet expectations.

The Societal Toll of Corporate Expansion

While Palantir’s impressive contract wins—like the $10 billion U.S. Army deal—suggest a strong foothold in government contracts, they also underscore the company’s deep entanglement in surveillance and military-industrial complex interests. These connections pose uncomfortable questions about the societal implications of Palantir’s technologies. The company’s expansion, fueled by both government and private sector contracts, raises concerns about privacy, civil liberties, and the shaping of a surveillance society. A balanced liberal perspective would demand that such rapid growth not only benefits shareholders but also considers the broader societal costs. Is this innovation truly serving the public good, or is it enabling increased state and corporate surveillance powers that threaten individual freedoms?

Palantir’s recent financial triumph appears more as a reflection of market enthusiasm and technological hype rather than a clear indication of sustainable, long-term innovation. The company’s focus on rapid growth, cost reductions through layoffs, and lofty AI promises should be viewed with skepticism, especially given the societal implications and the risk of overvaluation. While acknowledging Palantir’s achievements, a responsible, center-leaning position must insist on greater transparency, ethical standards, and a critical evaluation of whether this “revolution” genuinely benefits society or merely maximizes profits for a select few. In an era where technology’s impact on society is profound, celebrating such rapid growth without scrutinizing its broader consequences is a gamble—with the stakes being both economic stability and fundamental rights.